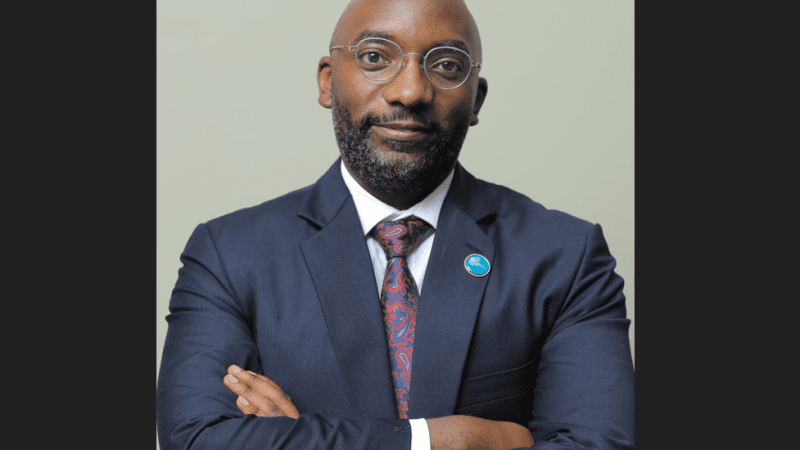

By Andrew Mwenda

Since government introduced a tax on mobile money and social media, there has been deafening opposition to it from every quarter of Ugandan public opinion. The very Ugandans complaining against this tax are the same people who constantly demand a large basket of public goods and services to be provided freely and/or very cheaply to every citizen by the state – education, healthcare, security, clean water, electricity, justice, agricultural extension services, roads, schools, hospitals, bridges, etc. If Ugandans don’t want to pay taxes, how do they expect the government to fund all this?

This is the real crisis of the state in Uganda and Africa generally. We have elites with a highly developed entitlement mentality for a nanny state. They want heaven and earth from the state and yet do not want to contribute anything to make it possible for the state to serve them. They own a cow they want to milk without feeding it. This is an absurd and counterproductive mentality that explains the real cancer eating our country and continent. The words of USA president John Kennedy in his 1961 inaugural address must be quoted here: Ask not what your country can do for you. Ask what you can do for your country.

I have a simple question for everyone here: if you disagree with this tax, which other tax do you have in mind that spreads the collection net widely to catch a large number of people? And if you want your government to do all the things you demand – and actually get – how do you want to it to fund them?

For many years the state has relied heavily on a few local businesses and foreign aid to fund the budget. This led to a situation where the state listened to donors instead of citizens on matters of public policy. When donors cut aid in 2012 over the anti homosexuality act, a law most Ugandans supported, the government avoided the hard choice of increasing taxes; deepening and/or broadening the tax base and went on a domestic borrowing spree. In just five years, domestic debt has grown to Shs 12.5 trillion with interest payments alone are now the largest part of the budget.

The claim that “we pay a lot of taxes” is nonsense. There are ways to measure this scientifically. One way is the ratio of tax revenues to the Gross Domestic Product (GDP). In Uganda this is very low, at 14% of a very miniscule GDP ($27 billion) compared to Sweden or Norway – the nations whose public goods and services Ugandans envy and demand – where it is 40 to 45% of a huge GDP ($540 billion and $440 billion respectively). The other way is tax revenue per person, which in Uganda is $106. How much can anyone get from $106 for a whole year? In fact this is 15% of per capital income in Uganda.

Why are our taxes small? First because our people are poor, there is little to tax. Second, the state’s tax administration infrastructure is very thin on the ground. Third, the state has a very limited economic map of the population to collect taxes from it because a huge part of economic activity is informal. Fourth, many economic activities in this country are tax-exempt. For example, 76% of imports are not taxed. Fifth, the government has always been afraid of the political backlash from taxing people. Given the hullabaloo over this tax I am afraid government may panic and withdraw it.

There is a lot to criticize about our tax policies and administration. Our government lacks a plan for broadening the tax base. This has led tax policy to always seek to extract the last penny out of a few existing taxpayers instead of bringing more people and activities under the tax bracket. The better strategy should be to increase productivity so that more taxes are collected from increased output. And quite important, government has no strategy for creating incentives to attract people from the informal to the formal economy so that it can tax them.

But be that as it may, the tax on receiving and sending mobile money and on social media is good because it makes very many people pay it directly. It has also made all Ugandans feel the tax burden deeply and personally. This is good politically because it has made Ugandans realise that they contribute to state coffers from whence they expect services. The response should not be asking the tax to be suspended but the government to account for what it does with it.

For tax administration purposes this is a good tax because it is impossible to evade and expensive to avoid. It is easy and cheap to administer because it is collected electronically. Mobile phone companies will act as collection agents for the state hence no need to hire more staff and build elaborate infrastructure for tax collection.

Secondly you can only avoid this tax by not consuming the service. But its demand is inelastic because alternatives are more expensive. If you decline to use the service to send money to your mother in Katakwi in order avoid this tax, the cost of taking it in person is much higher. Secondly, the inconvenience of looking for a person who lives near your mother to take it there for you, is too much, not to mention the risk of him/her stealing it.

The use of social media for texting and voice calls has reduced government revenues from Short Message Services (SMS) and voice calls. This tax is therefore one way to compensate for this. If anyone uses social media to earn money, surely Shs 200 per day is not too much to ask. And I don’t see a problem with government using this tax to penalise those who use social media for lugambo and to hurl insults at others.

The great advantage of this tax is that is spreads the net widely thereby bringing many more Ugandans into the tax ambit. Right now only about 760,000 people are registered for personal income tax called Pay As You Earn (PAYE) or Pay As Yoweri Enjoys, which is true. The joke aside, 760,000 registered taxpayers in a population of 40m or an adult population of 17m is a scandal. Secondly, there are 236,000 individuals with businesses registered to pay taxes in Uganda. Yet only 24,600 actually pay taxes and a miniscule 4,150 pay 80% of it.

For far too long, the government of Uganda has been reluctant to tax the vast majority of its citizens for fear of a political backlash, like the one we are seeing today. It abolished graduated tax for populist reasons. Hence it has always relied heavily on the generosity of its Western benefactors through foreign aid. At one time foreign aid was 56% of the government budget. However, when Uganda passed the anti-homosexuality act in 2012, most aid was cut. Rather than cut spending and/or increase taxes, government went borrowing on the domestic market and also turned to China on the international credit market.

Before 2012, government used domestic borrowing only for monetary policy i.e. to control money supply. After the aid cuts, government began borrowing from the domestic market for fiscal purposes i.e. to finance the budget. This has led domestic debt to raise to Shs 12.5 trillion in 2018 with interest payments now the largest cost on the budget, a development that has attracted the ire of many Ugandan elites. Ironically, the very Ugandans denouncing government for imposing this tax have been the same people denouncing it for increasing debt.

Secondly, too much domestic borrowing has crowded the private sector out of financial markets. This has led to slow growth in the private sector not to mention discouraging private investment. This has led to sluggish GDP growth over the last five years – from an average of 7.2% in the 20 years between 1993 and 2012 to an average of 4.1% in the last five years. Indeed high interest rates on treasury bills and bonds has led interest rates for private firms to skyrocket causing many companies to default on their loans and some to go under.

There are many problems – both economic and administrative – with the new tax. But regardless of the weaknesses, I think it is good. From a political perspective, its biggest inefficiency (charging both senders and recipients of mobile money and asking people on social media to pay the tax directly instead of deducting it from their airtime) is actually its greatest advantage. Because many Ugandans are being taxed directly, they are now feeling the pinch. It is very likely that (holding many factors constant) they will now become more vigilant in holding government to account to serve them than they have ever done.

For far too long, the government of Uganda had avoided making citizens pay for the public goods and services they demand – and get – by relying on domestic and international borrowing. This disarticulated the state from citizens and made its creditors the most important influence on public policy. The state should rely on citizens for revenue. This has created a golden opportunity for citizens to engage the state over public policy. If this happens it may contribute to consolidating our democracy.

A note to President Yoweri Museveni: you have always fought hard to keep your job. Please for the first time in your presidency use the same energy to fight to keep this tax, because it is good for this country’s politics and revenue. The vast majority of Ugandans are against you. But you are right and they are wrong. For once stand firm against public opinion in defense of something where you don’t have a pecuniary interest.

Andrew Mwenda is a Ugandan Journalist and a close ally of President Yoweri Museveni