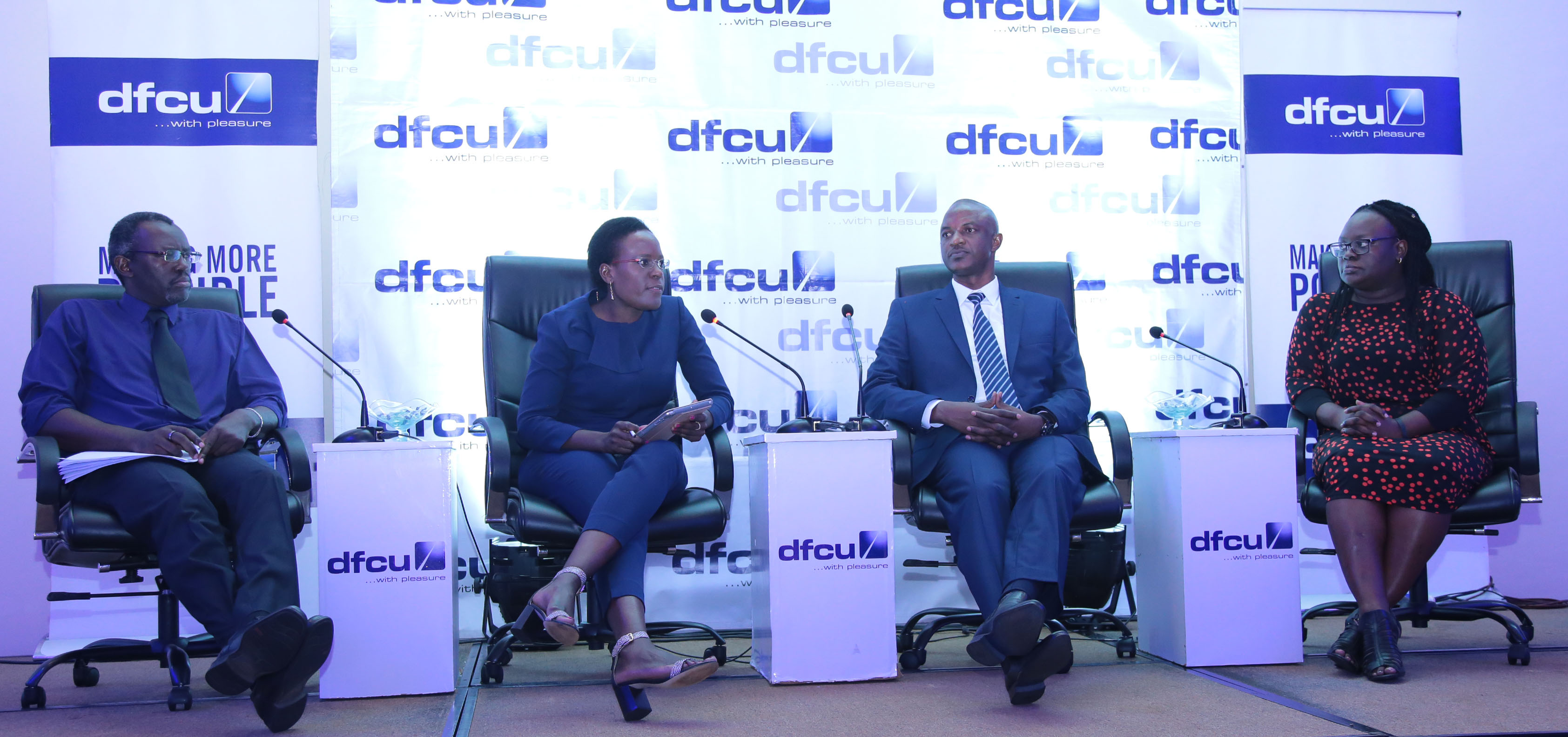

dfcu Bank customers can now access medical insurance, life insurance, funeral and related expenses insurance and so much more by simply having specific accounts with the Bank. This was revealed this morning at a Bancassurance dialogue organized by dfcu under the theme, “Securing a sustainable legacy.”

With the penetration of insurance still very low at 1%, the insurance sector and its affiliated regulatory bodies are developing new channels to increase uptake and influence attitudes about insurance. Bancassurance – the selling of life assurance and other insurance products and services by financial institutions is expected to support this growth agenda.

Speaking at the event, dfcu Bank’s Chief Commercial Officer and Executive Director; William Sekabembe revealed that dfcu Bank, has taken a slightly different approach to Bancassurance. “Bearing in mind the needs of our customers and the current socio-economic times, we have designed and embedded insurance within some of our existing products to make it easier for customers to appreciate and get the best out of insurance,” he said.

“We believe that dfcu Insurance presents customers with a better way to secure a legacy whether it is about getting cover for their assets, education for the children, life after employment and so much more. So we have created several insurances products- for our customers with individual accounts and for those with group portfolios such as our Investment Clubs,” he added.

According to Martha Aheebwa, the dfcu Bank Principal Officer – Bancassurance, some of the insurance products include; Investment Clubs cover, Salary protection cover, Hospital cover for Dembe accounts and so much more. Other off-the-shelf insurance products available at the 66 dfcu branches countrywide include motor insurance, fire and burglary, domestic insurance cover to medical insurance, life insurance and property insurance.

“We believe that dfcu Insurance presents customers with a better way to secure their legacy whether it is about getting cover for their assets, education for the children, hospital cover, or life after employment. Over the coming months we will engage more with our customers to assess their requirements as a basis for enriching our product offering to meet their needs and provide more value,” she added.