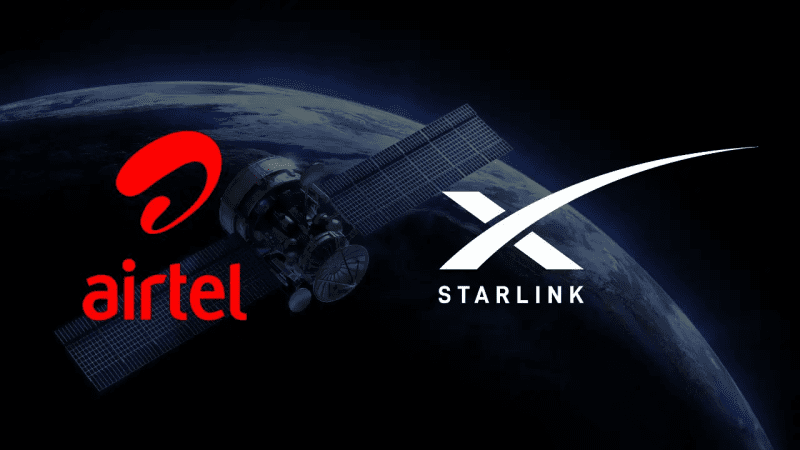

The Kenya Revenue Authority (KRA) has confirmed that the new digital service tax (DST) came into effect on 01 January.

The Finance Act 2020 introduced DST on income from services provided through the digital marketplace in Kenya and will be applied at 1.5 percent on the gross transaction value, excluding VAT.

The new tax will apply to such services as downloadable digital content, including mobile applications, e-books and films. Over-the-top (OTT) streaming television, films, music, podcasts and any form of digital content will also be subject to DST.

It will also be charged on subscription media including news, magazines and journals, providers of a digital marketplace, and those who monetise data collected from user activity on a digital marketplace.

KRA added that the tax will be due at the time of transfer of payment for the service to the provider. One will be subject to DST if one provides or facilitates provision of a service to a user who is located in Kenya.

The new tax is also targeting firms or individuals offering website hosting, online data warehousing, file sharing and cloud storage services. Firms that sell tickets online and IT firms that provide search engine services, and those offering distance training, will be subject to DST.

——————–

By: Telecom Paper