Rwanda is considering collecting Value Added Tax (VAT) on online services used in the country, Rwandan local press reported.

According to information from the Rwanda Revenue Authority (RRA), the proposal is currently at the Ministry of Finance and Economic Planning, from where it will undergo several procedures before it can start to be implemented.

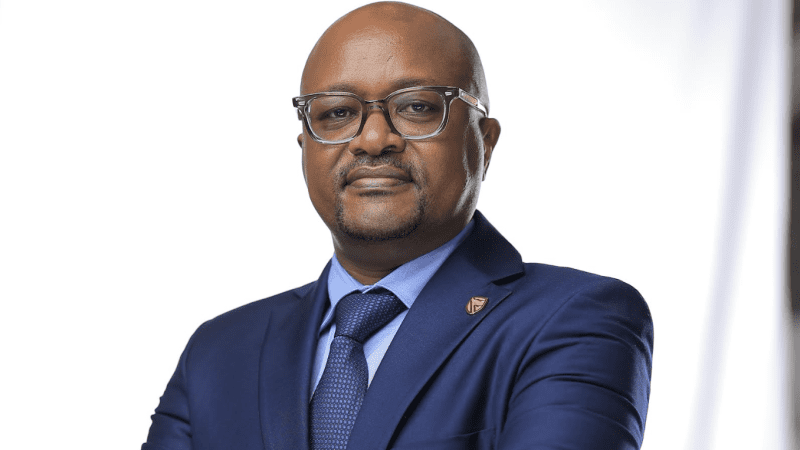

Jean-Louis Kaliningondo, the deputy commissioner general at the RRA, said that “one of the big principles” about VAT is that it is paid to the country where the service is being used.

Kaliningondo said some African countries have laid out plans to levy VAT on foreign digital services, including South Africa, Kenya and Nigeria among others.

Kaliningondo said that before Rwanda implements this move, it must undertake an impact assessment.

It wants to find out whether the VAT would hinder penetration of these services in the country.