By: Michael Jjingo

What fuels entrepreneurship survival over generations? In the last few weeks, while training entrepreneurs about corporate governance, some confided that their dream is to sustain and pass on their businesses to future generations. This piece attempts to delve into this matter of multi generations wealth that is seen as a preserve of Asians and a few Ugandans like Mr. Mulwana, Prof. Mukiibi, BMK, Musa Body, to mention but a few.

Many rhetoric speakers always assert “You cannot take it with you”. How often have you heard that? Some other comic readers of announcements at funerals, like Jjemba, will announce the cause of passing as “business stress”, and that marks your end of the road, as you get a permanent residence, call it a rest in peace.

True, building our families around the concepts of running a business, from evaluating new proposals to reading a balance sheet, should also be at the core of multi-generational growth. If our family member is not aware of the basic system on which business is built, they may not feel confident about stepping into a leadership role. Better to develop a strong leadership training program to help future leaders understand how the company operates and come up with creative solutions if any problem resurfaces.

A new reality is written on the wall. The world before Covid 19 is in the past. This is the time for innovations or black ocean ideas, expansion, flexibility, and opportunity. A family business is continuously changing. Evolution, adaptation, and change are a must have! At a second look, response to customer needs determines the sustainability of any business.

Creating a culture of strong values can help sustain a family business, as it is much more resilient than the system that the business is built upon. Those who run a business know that the people both in front of and behind the system are the most valuable resources and that when you create a culture with strong core values, the people will be able to more easily guide the business through a generational transition. The value system will always quell the ensuing conflicts.

Well, to build a sustainable family business is to cultivate an environment that develops respect for experience. A big challenge for many businesses is that the transitions between the generations may come at the cost of losing generations of experience and having to learn lessons from making the same mistakes that were made before. Preserving the prior generation’s experience and mixing the ambition and innovation of the next generation is one key to a successful generational business.

From an entrepreneurial perspective, educating our kids about how debt works is a massive leap toward building generational wealth. We should encourage our businesses to break the old habits and stigmas around debt for our own sake. Learn to identify the difference between consumer debt and the working debt you can leverage. Calculated debt backed by growth sparks exponential growth.

Conservative generations are hard to change and thus kill innovations. There are no limits to how many times you can re-energize the business focus or mission statement. Each generation can bring its own unique perspective and skills into the management of a business. Noteworthy to understand that mistakes will be made and that the team can learn from them; this is part of how a business will change through multiple generations of ownership.

If you are unlucky like me growing up without a family legacy business, but with side-hassles, you may not feel that it is your obligation to develop and nurture a generational business. Better to develop the passion that will suit your lifestyle. There are many options if the next generation is not ready to step up, as it is possible to let it out or pause the business.

Generally speaking, the family business sometimes has a distinct advantage of taking a long-term view of trends and adapting quickly to the changes of the industry. Small businesses like corner shops may be able to withstand external impacts, natural disasters, and economic downturns more easily due to their long-term strategic view. Advisable to focus on the goals for the next generation.

Besides, and thanks to inflation, the money that you leave behind for your kids will evolve in value. Our education systems throughout the country offer little education when it comes to money management. We need to start teaching our kids how to handle money properly if we want to build generational wealth. “He who has a why to live for can bear almost any how” — Friedrich Nietzsche. But, better never to compromise our family time, plus the social net worth.

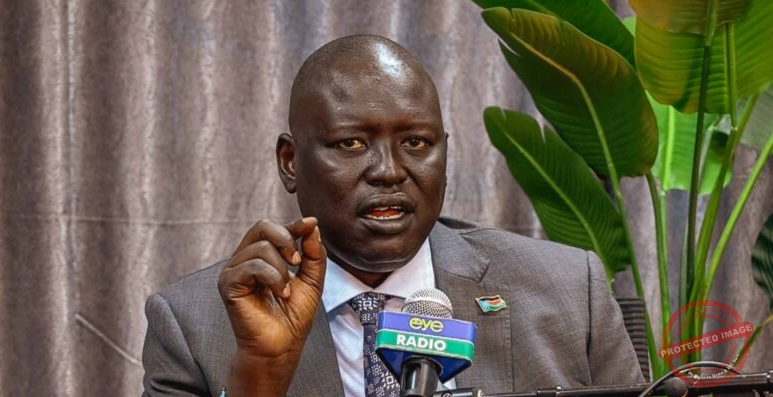

The writer is the General Manager Commercial banking at Centenary Bank.