The Bank of South Sudan (BoSS) on Monday threatened to shut down commercial banks that are performing poorly.

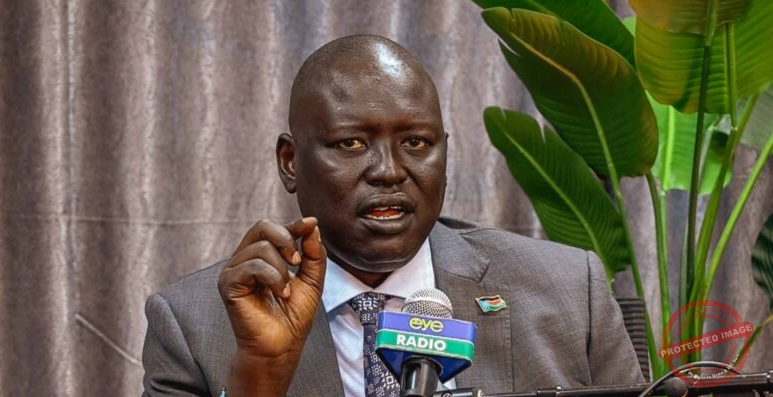

Appearing before the Transitional National Legislative Assembly (TNLA) on Monday, Central Bank Governor Johnny Ohisa Damian revealed that most of the local commercial banks are undercapitalized.

“The licensing is done by the Central Bank and there are of course regulations to govern the licensing of commercial banks,” he said. “However, most of our banks or let me say most of our local banks are really weak in a sense that they are undercapitalized, they are not performing.”

Ohisa suggested that the country should have three strong national commercial banks with branches all over the country than having many that do not perform.

“Now we are working on financial sector reforms and by that we mean it will lead us to take tough decisions to the extent that we will have to close some of the banks that are not working,” he said. “If I can have 3 local banks that are big and can have branches all over the country, it is better than having 14, 15, or 20 banks that are not capitalized.”

According to Governor Ohisa, most of these banks are owned by individuals and have no proper governance structures.

“When we encouraged local people to open banks after independence, everybody with money went and opened bank disregarding the fact that commercial banks require a lot of preparations and a lot of governance issues to be instituted,” he said. “We now have commercial banks, especially local banks, which do not even have a board of governors. The chairman and the owner are everything and he can take loans at any time he wants and that is why a lot of commercial banks are suffering.”

About 12 licensed national banks are operating in South Sudan momentarily.