MTN Uganda, the country’s leading mobile phone operator, has posted a remarkable 21.1% increase in its profit after tax for the third quarter of 2023, as the company continues to thrive on the back of a growing customer base and burgeoning demand for data and fintech services.

The profit after tax surged to Shs 354.4 billion for the quarter ending September 30, 2023, up from Shs 292.6 billion during the same period last year. The service revenue recorded an impressive uptick, climbing by 15.2% to Shs 1.9 trillion. The company’s mobile subscribers increased by 13.9% to 19 million.

This impressive performance has prompted the board to approve a second interim dividend of Shs 6.0 per share (Shs 134.3billion), a noticeable increase from the previous year’s Shs 5.4.

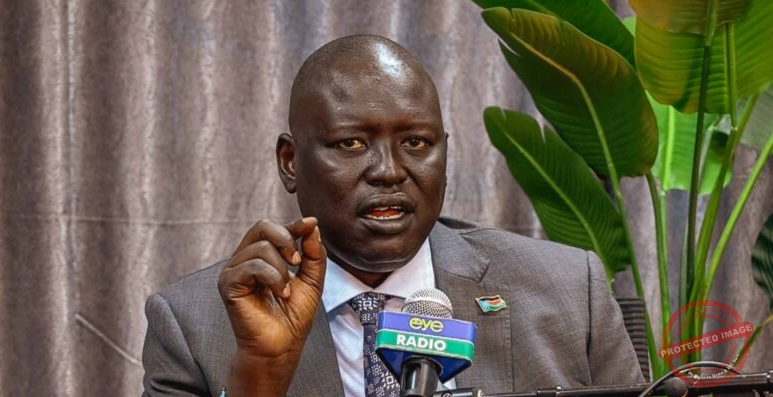

MTN Uganda CEO, Sylvia Mulinge, has attributed this success to the company’s solid commercial execution and the improved macroeconomic environment.

“We continued to invest in our customers through continuous product innovation and improved service delivery, setting up over 360 additional service points this year to provide a best-in-class customer experience.”

She said a significant reduction in inflation, down to an average of 3.3% compared to 9.0% for the same period the previous year, supported the positive results.

She said while the decrease in inflationary pressures resulted in a 50-basis points reduction of the key lending rate to 9.5%, increased foreign direct investment driven by the oil sector also played a role in stabilizing the local currency.

Data and Fintech Triumph:

Data revenue witnessed consistent growth, expanding by 22.0%. Improved network quality and value-packed data offerings attracted more customers, as the number of active data users increased by 23.0% to reach 7.5 million, with data usage per active user rising by 20%.

MTN Uganda’s investments in 4G and the introduction of 5G technology significantly enhanced the user experience, resulting in a 51.0% growth in data traffic, with a substantial portion carried on the 4G network.

Efforts to boost smartphone adoption yielded substantial success, with smartphone penetration reaching 36.6%, marking a notable increase of 3.9 percentage points. Initiatives such as the MTN Kabode flagship product and partnerships offering improved pricing and value propositions played a pivotal role in accelerating smartphone adoption.

Fintech revenue also demonstrated robust growth, surging by 18.1%. Basic revenues from peer-to-peer (P2P) and money transfers exhibited substantial expansion due to increased acceptance of mobile money. The number of fintech subscribers grew by 9.7% to reach 11.6 million, with a significant uptick in the adoption of the MoMo Pay platform.

Digital revenue experienced extraordinary growth of 130.0%, driven by an increase in content value-added services and enterprise digital solutions that utilize open Application Programming Interfaces (APIs). Customers leveraged MTN’s network assets to enrich their products and services, further contributing to the company’s profitability.

Going forward

Ms Mulinge expressed optimism regarding Uganda’s resilient and growing economy, with the central bank projecting a robust economic growth rate of 5.3% for the fiscal year 2022/2023.

“As we close the year, our focus remains on maintaining the growth momentum of our overall portfolio with attention to our new growth segments of home broadband, enterprise, and digital,” she stated.

She continued, “For our GSM business, our rigorous customer acquisition strategy and Customer Value Management initiatives around our voice propositions will be key to ensuring that we finish strong. On the data front, our focus is on optimizing our 4G and 5G network with increased home and business activations and smartphone penetration to harness the wide investment in infrastructure and spectrum opportunity.”

Mulinge highlighted the company’s commitment to its value-based capital allocation strategy and ongoing efforts to augment its capital structure to ensure balance sheet strength.

She emphasized that MTN Uganda’s funding and liquidity are well-managed, supported by cash flows and approved local currency-denominated facilities to meet financial obligations.