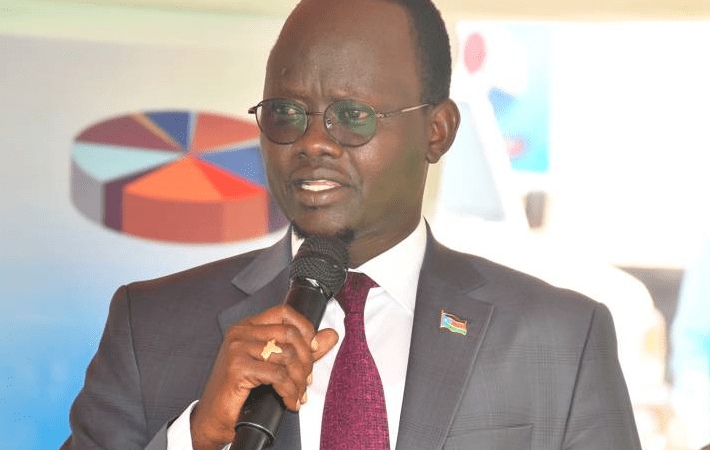

The Central Bank of South Sudan has unveiled a plan for economic transformation. Emphasizing the operationalization of policies within the bank’s modernization strategy, Central Bank Governor Dr. James Alic Garang highlighted the formalization and streamlining of the informal foreign exchange market.

“We are committed to achieving our economic transformation agenda. From the perspective of the Bank of South Sudan, we believe that now is the opportune time to implement the policies outlined in our bank modernization strategy. One key policy we emphasize is the necessity to streamline and formalize the informal foreign exchange market,” Dr. Alic said on Friday.

“The Central Bank cannot tackle this task alone. The media plays a crucial role in conveying this message to the general public. We also anticipate support from the public in operationalizing the policies outlined in our modernization strategy,” he added.

He emphasized the need for coordination and explained the ultimate goal: “Our aim is to operationalize, streamline, and formalize the informal foreign trading market to achieve currency market stabilization. This, in turn, will stabilize prices and enable us to fulfill our core mandate of ensuring price stability.”

Detailing the medium-term plans, Dr. Alic stated, “To address current challenges, the Central Bank will continue directing additional foreign exchange to both commercial banks and forex bureaus. This is to meet the needs of the public, businesses, and other stakeholders participating in the foreign exchange market.”

Dr. Alic provided a timeline for implementing new guidelines: “Starting from Monday, December 4th, to December 14th, unauthorized currency traders are authorized to operate strictly in four designated locations across Juba.”

He outlined the locations for phase one and warned against operating beyond designated areas: “These locations include the area between Equity Bank and National Credit Bank in Juba, the main market of customs, Jebel market, and Konyo-konyo market.”

Dr. Alic clarified the expectations during this phase, stating, “We are requesting foreign currency traders to reorganize themselves within these specific areas. Between December 4th and December 14th, we do not expect them to operate in shops. Once phase one concludes, we will move to phase two.”

In phase two, Dr. Alic urged foreign currency traders to operate under a roof, within a shop or structure, emphasizing the formation of associations for mutual support and compliance with registration requirements.

He explained, “The Central Bank will revise guidelines and regulations to support the formation of associations and the registration process.”

Dr. Alic also addressed the regulation of local money transfers and emphasized the importance of monitoring informal foreign exchange trading for effective monetary policy.

“In phase three, our long-term goal is for all hard currency trading in South Sudan to occur within premises, with traders obtaining licenses, issuing receipts, and fulfilling their tax obligations to the government,” he said.

Dr. Alic stressed the need for informal foreign currency traders to form groups, consult banking supervision departments, obtain operation licenses, and operate under permanent structures.

He warned of strict enforcement by engaging other stakeholders, including the Juba City Council and law enforcement agencies, for non-compliant market participants.

Dr. Alic concluded by stating that these measures are aimed at streamlining trading activities and mitigating currency risks, leading to the formalization of unauthorized dealers into the mainstream currency market. He reiterated that achieving a bank modernization strategy is crucial for economic growth, employment creation, and improving living standards.