In a move poised to transform Uganda’s investment landscape, SBG Securities, a subsidiary of Stanbic Uganda Holdings Limited, has launched the Stanbic Unit Trust (SUT), an innovative investment vehicle that empowers Ugandans to pool their resources, leveraging professional fund management to generate favourable returns.

SBG Securities is a subsidiary of Stanbic Uganda Holdings (SUHL), a listed entity on the Uganda Stock Exchange operating four other businesses including Stanbic Bank Uganda, Stanbic Properties Uganda, Stanbic Business Incubator and FlyHub.

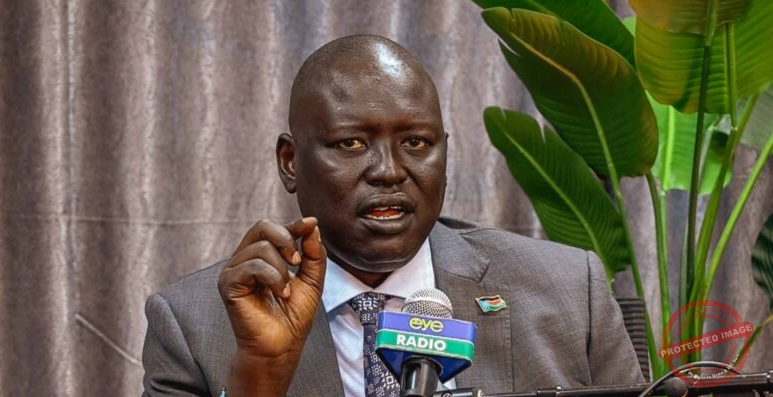

“Tonight, we are here to celebrate the success of one of our young businesses—SBG Securities, the entity specialised in investment management and advisory. We are launching the Stanbic Unit Trust on the back of recent success including the delivery of the MTN Uganda IPO in 2022—Africa’s largest in that year, and of course the just concluded secondary market offering which registered oversubscribed participation,” said SUHL Chief Executive Francis Karuhanga.

Breaking Barriers to Investment

With a minimum investment requirement of just UGX 100,000 and subsequent deposits as low as UGX 50,000, SBG Securities Chief Executive Grace Semakula told patrons at the launch event that, ‘the SUT shatters traditional barriers to entry, making investment accessible to a wider audience.’

“Our team of experienced fund managers will navigate the investment environment, diversifying portfolios across treasury bills, bonds, fixed deposits, and shares to minimize risk and maximize returns for our customers,” said Semakula.

The Stanbic Unit Trust accommodates various investment goals and needs, offering three distinct funds including Money Market Fund (short-term), Bond Fund (medium-term), and Balanced Fund (long-term). Semakula said, clients can also invest jointly, for minors, or as part of a savings group.

Transparent and Affordable

With an annual management fee of 2%, investors can trust SBG Securities’ professional oversight and management, further consolidated by being a member of the Standard Bank Group—Africa’s largest commercial bank by assets.

The Stanbic Unit Trust is designed to be an affordable and reliable investment option, making it an attractive choice for Ugandans seeking financial growth.

Today, most Ugandans shy away from conventional investment tools such as stock investment, preferring investment in land or rental construction. However, recent trends have seen a surge in uptake in unit trusts as they find them more transparent and affordable.

For instance, the global mutual fund industry manages over $60 trillion in assets, according to the Investment Company Institute reporting for 2022). In Africa, the collective investment scheme (CIS) industry has also grown significantly, with assets under management reaching $120 billion, according to a 2022 survey by Africa Collective Investment Scheme.

“In Uganda, we are also seeing the unit trust industry showing strong growth, with assets under management increasing by 20 per cent in the past year alone, according to reporting by Capital Markets Authority Uganda.

At Stanbic Uganda Holdings, we want to enable our customers tap into this impressive growth and not be left behind ensuring that they have access to financial investment services and that’s why we have designed the Stanbic Unit Trust,” said Karuhanga.

Join the Investment Revolution

Potential investors can onboard easily, either physically at SBG Securities’ offices or digitally through their website. Simply provide a National ID, passport photographs, and complete the requisite forms.

“The Stanbic Unit Trust is a game-changer for Ugandan investors,” said SBG Securities Board Chair Aggie Konde. “Our team of young expert professionals led by our Chief Executive Grace Semakula will ensure you enjoy a low-risk investment experience for your savings, coupled with flexible contribution options enabling individuals to steadily grow their funds,” said Konde.