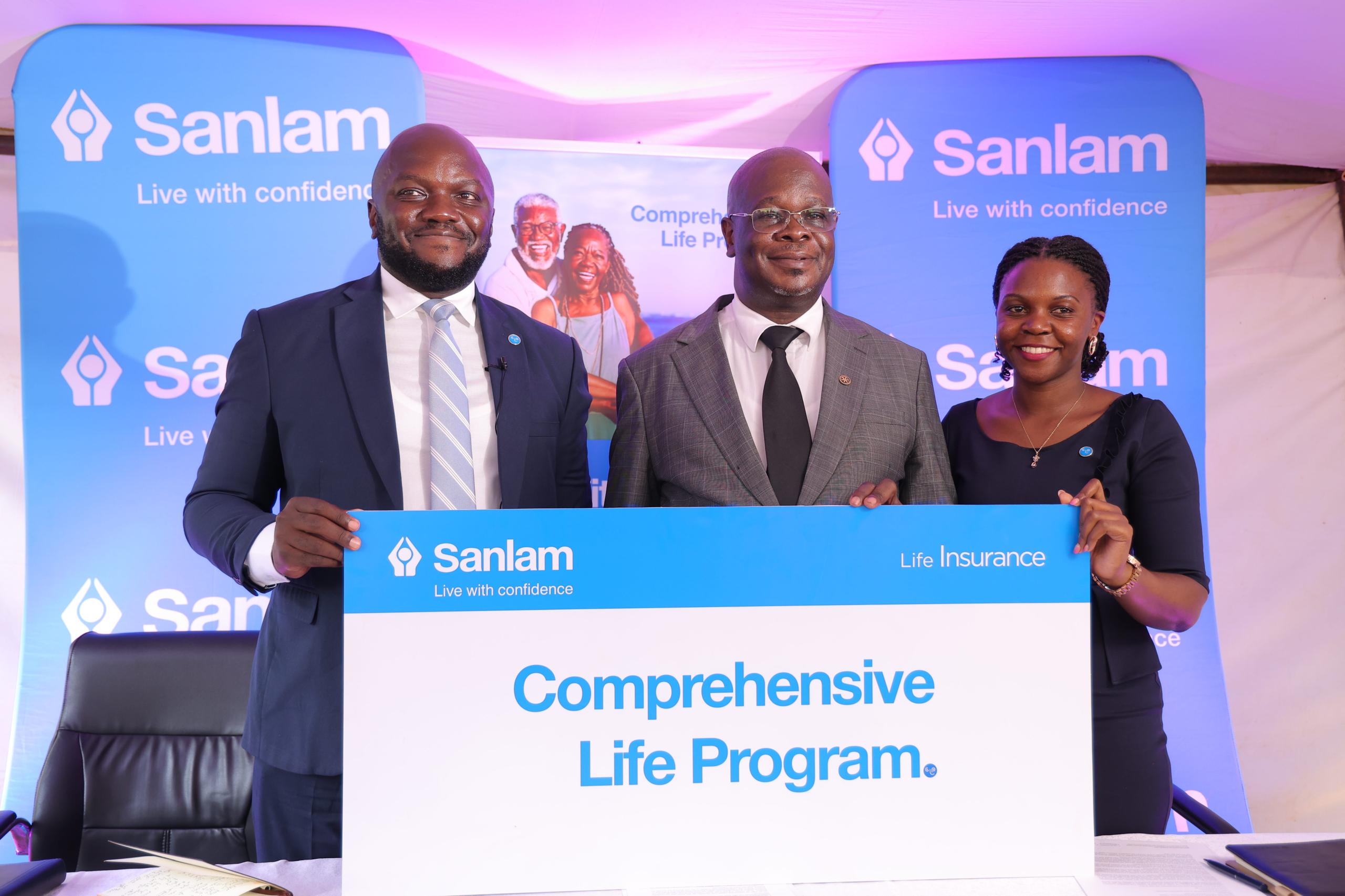

Sanlam Life Insurance Uganda, one of the leading providers of life insurance services in the country, has today, launched the Sanlam Comprehensive Life Program, a funeral plan designed to give essential financial protection to Ugandan families during one of life’s most trying moments.

While addressing the media at the launch, Sanlam Life Insurance Uganda, Chief Executive Officer Gary Corbit, expressed the great need and timeliness of this product launch, noting that its launch is a testament to Sanlam’s commitment toward the goals of securing the financial future of Ugandans.

“Loss is an inevitable part of life, and its impact can be overwhelming. The pain of losing a loved one can be compounded by the financial burden of funeral expenses,” Corbit stated. “Understanding this reality, we designed the Sanlam Comprehensive Life Program to provide a safety net during life’s most difficult moments.”

The Sanlam Comprehensive Life Product is available to people between the ages of 18 to 65 years and comes in packages to best suit every customer—from people on a budget to those with more financial resources.

The product consists of The Funeral Cover Benefit which provides a lump sum payout, adjusted for inflation, to support families during their time of need. The Family Income Benefit offers 10% of the cover amount as monthly income for three months after the policyholder’s or spouse’s death, while the Last Supper Benefit grants UGX 300,000 for immediate expenses. For accidental deaths, the Double Accident Cover Benefit doubles the payout. Additionally, the policy waives premium payments and converts to paid-up status if the policyholder dies or becomes permanently disabled. Finally, the Cash Back Benefit rewards policyholders with 20% of premiums paid every three years, regardless of claims made.”

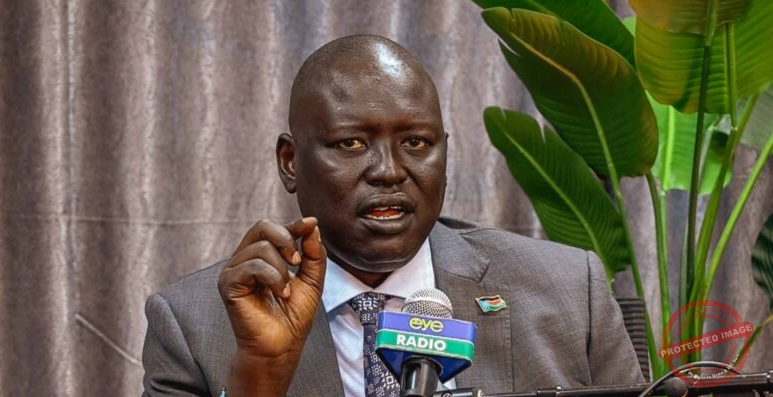

Attending the launch, Mr. Bernerd Obel the Director Provision at Insurance Regulatory Authority (IRA) commended Sanlam Life Insurance Uganda for its collaborative effort in coming up with insurance solutions designed to meet the needs of customers in Uganda and support the growth of the industry.

“For our industry to successfully close the existing coverage gap in Uganda, there must be active collaboration between insurers, bankers and telecom operators and ourselves as regulators. The inclusive nature of Sanlam’s new program highlights how partnerships between insurers and regulators can lead to the creation of well-rounded solutions that benefit consumers and the market as a whole.”

Obel stated further adding that the innovation of this product aligns with IRA’s strategic vision for the industry as well as regulations. “Our regulatory framework aims to strike a balance between encouraging innovation in the insurance sector and ensuring that these innovations are rooted in fair practices, transparency, and market stability. We are particularly pleased to see that Sanlam has structured this product with features that cater to diverse market segments, ensuring inclusivity and accessibility for all, from the budget-conscious consumer to the more affluent.”

He urged Sanlam Life Insurance, and the wider insurance industry, to continue leveraging technology to bridge the gaps in financial protection for Ugandans. “Technology has transformed how businesses operate, and insurance is no exception. By embracing digital solutions, we not only enhance the customer experience but also expand access to insurance to those in remote areas who might otherwise be excluded,” he explained.

Sanlam Life Uganda remains committed in the journey of creating a future where every Ugandan family would have aspired to the financial security they deserve, even in the most challenging times. Sanlam Life Comprehensive Program is available at all Sanlam Life Insurance services centres and agents in Uganda.