Parliament has approved the government’s request to borrow $190 million (shs699.938 billion) from Stanbic Bank for the buyout of Umeme.

This came on the heals of recommendations from both the Auditor General and the Parliamentary Committee on National Economy to halt the process until the actual buyout amount is determined.

During the parliamentary session, Attorney General Kiwanuka Kiryowa requested the suspension of Rule 155 (3) of the Rules of Procedure, which requires the Committee on National Economy to present its report on the Umeme buyout loan before Parliament can consider it.

He argued that any delays in paying off Umeme would result in penalties for Ugandan taxpayers.

“This matter of Umeme has been with us for a very long time. It is a very urgent matter, and the deadline upon which we are supposed to make this payment ends on 31, March 2025. If we don’t, there will be penalties and costs. I request that we suspend the operation of Rule 155 (3) in accordance with Rule 16, so the Committee of the Whole House considers this,” said Kiryowa.

His request came at a time when the Auditor General had asked Parliament to halt the loan approval to allow his team to establish the actual buyout amount, citing inconsistencies in the figures provided by both the government and Umeme.

“This matter of Umeme has been with us for a very long time. It is a very urgent matter and the deadline upon which we are supposed to make this payment ends on 31st March 2025. If we don’t, there will be penalties and costs. I request that we suspend the operation of Rule 155 (3) in accordance with Rule 16 so the Committee of the whole House considers this,” said Kiryowa

The Committee on National Economy had earlier advised Parliament to delay approving the loan, citing discrepancies in the figures provided by the government regarding the buyout cost.

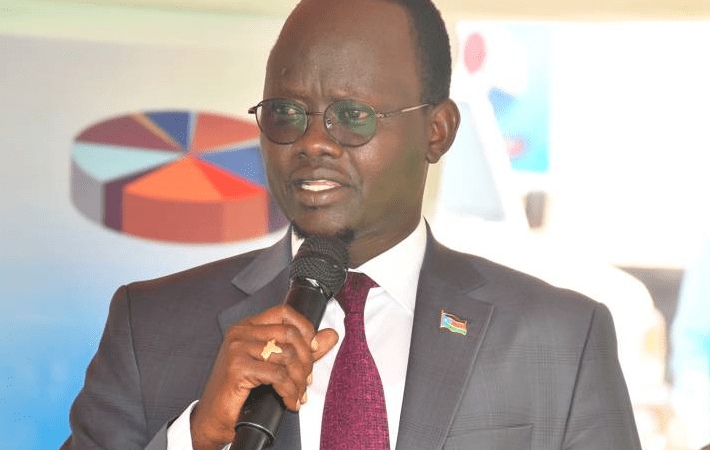

While presenting the Committee’s report, John Ikojo, the Committee Chairperson, emphasized the need for clarity on the final amount owed to Umeme before proceeding with the loan.

“Given that the Auditor General has not determined the final buyout amount and considering the period remaining to come to the end of the LAA, the Auditor General expeditiously reconciles with ERA and UEDCL to determine the final UMEME buyout cost and submit to Parliament to guide approval of the loan request. Given the above observations, the Committee recommends that the Government proposal to borrow up to Euro equivalent of USD 190,988,556 from Stanbic Bank for the UMEME buyout be halted until the report of the Auditor General is presented to Parliament,” said Ikojo.

In support of this recommendation, Charles Tebandeke, the Bbaale County MP, in his minority report, urged the government to ensure that all individuals and companies holding shares in Umeme are fully informed about the status of their shares.

During the debate, Denis Oguzu, the Maracha County MP, questioned the government’s decision to borrow from Stanbic Bank while other potential funding sources were available.

He specifically pointed out the Escrow Account, where Umeme had been depositing rent and other payments, suggesting that funds from this account could be used for the buyout instead of taking on new debt.

“In the Leasing and Assignments Agreement, there is an account called the Escrow Account on which Umeme has been paying rent and other incomes. To date, nobody in this country knows what that account is holding and yet this same agreement provides that if there are any obligations, they can be paid from that account,” said Oguzu.

He also highlighted another funding option under the Umeme Licensing Agreement, known as the Liquidity Facility, which allows the government to invoke a guarantee if it is unable to meet its obligations to Umeme.

“There is what we call Liquidity Facility in the Leasing and Licensing Agreement. What that facility does, if Government isn’t ready to meet any obligations to Umeme, the guarantee under that Facility can actually be evoked. Up to now, we can’t understand why we have chosen to do borrowing when the option,” noted Oguzu.

Despite these concerns, Parliament went ahead and approved the loan, leaving questions about the transparency of the buyout process and the government’s reluctance to explore alternative funding sources.