Diamond Trust Bank (DTB) Uganda, a leading financial institution in Uganda, has today announced a new partnership with Furaha Finserve Uganda Limited aimed at easing the burden of school fees for families across the country.

The collaboration introduces the DTB–Furaha School Fees Loan, a digital financing solution that gives parents timely and affordable access to school fees, helping children stay in school and complete their education.

The new product allows parents to secure instant school fees loans that are paid directly to schools, easing the burden of upfront lump-sum payments.

This initiative comes against the backdrop of a pressing national challenge. Statistics from the Ministry of Education and Sports (MoES) Of every 100 children who began primary school in 2012, only 10 sat for their S6 final examinations in 2024, with school fees remaining one of the biggest barriers to continued learning.

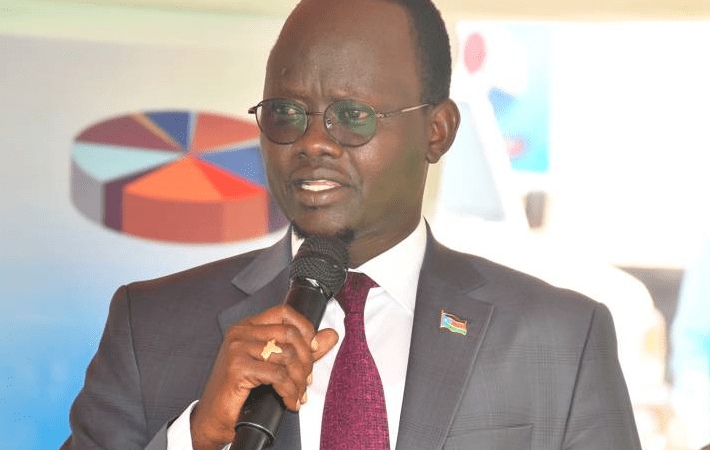

Speaking at the launch, Godfrey Sebaana, CEO of Diamond Trust Bank Uganda, said the partnership underscores DTB’s commitment to addressing real challenges in the communities where it operates.

“Our partnership with Furaha Finserve Uganda Limited is built around one clear goal: keeping children in school. Through this collaboration, we are unveiling the DTB–Furaha School Fees Loan, a digital solution designed to ease the heavy termly pressure parents face.” he said.

The DTB–Furaha School Fees Loan is designed for simple, secure access. Parents can apply through the Furaha App or dial *165*80#. With only a National ID needed for registration, users can enter the student number, select the preferred payment plan, and have the loan paid directly to the school. DTB teams at the branch level are ready to support parents who need assistance using the new platform.

Sebaana further explained how the initiative aligns fully with the bank’s long-term vision.

“Our goal is to support more than one million children to stay in school over the next five years. This is responsible finance in action and a direct investment in Uganda’s future,” he noted.

The partnership also sets the stage for broader impact. In its second phase, DTB and Furaha will introduce financing for electric motor vehicles in Kampala, along with other productive assets such as clean cooking gas, supporting the shift toward cleaner and more sustainable living.

Dennis Musinguzi, CEO of Furaha Finserve Uganda Limited, said the collaboration demonstrates the power of purpose-driven digital finance.

“Our platform was built to solve real challenges, and school fees remain one of the biggest pressures on Ugandan families. Working with DTB allows us to scale this solution and ensure more children stay in school without interruption,” he said.

DTB is calling on parents, schools, and education stakeholders to embrace the new digital school fees tool. With more than twenty thousand schools across Uganda, the potential for impact is significant.

The DTB–Furaha School Fees Loan is now live and open to all eligible parents nationwide.