The Bank of Uganda (BoU) has decided to maintain its central bank rate (CBR) unchanged at 9.75%, citing the need to support continued economic expansion while anchoring inflation within target levels.

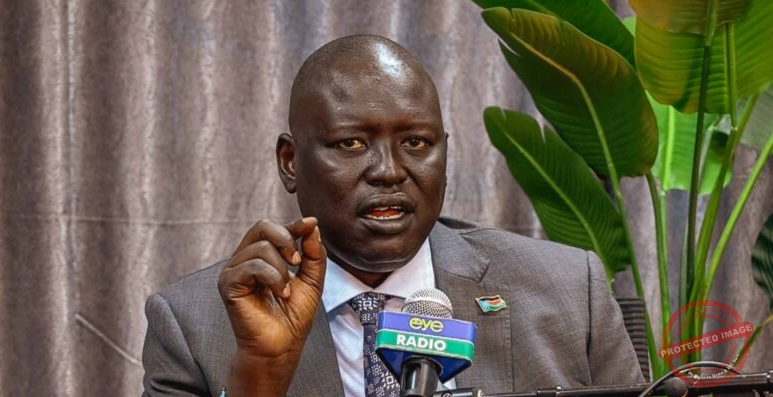

Announcing the decision after the Monetary Policy Committee meeting, Governor Michael Atingi-Ego described the current policy stance as appropriate amid persistent global uncertainties.

Headline inflation averaged 3.5% over the 12 months to January 2026, remaining comfortably below the government’s medium-term target of 5%.

Core inflation, which strips out volatile food and fuel items, stood at 3.8% over the same period.

In January alone, headline inflation edged up slightly to 3.2% from 3.1% in December 2025, driven mainly by higher costs in services—particularly passenger air transport.

Food crop inflation, however, eased to 3.0% from 4.4%, reflecting improved supplies due to favourable weather.

Energy, fuel, and utilities inflation rose modestly to 1.7%, largely due to elevated firewood prices.

The BoU has slightly lowered its inflation outlook for 2026, projecting it to range between 3.8% and 4.3% before gradually stabilising around the 5% target in subsequent years.

Key supportive factors include a stronger Ugandan shilling, declining global oil and food prices, and sustained prudent monetary policy.

Governor Atingi-Ego cautioned that risks to the outlook persist on both sides. Upside pressures could emerge from robust domestic demand, exchange rate depreciation, geopolitical disruptions, or adverse weather.

Downside risks include weaker global growth and falling commodity prices.

Uganda’s economy demonstrated resilience in 2025, recording average growth of 6.3%, fueled primarily by increased government and household spending.

For the 2025/26 financial year, the central bank forecasts growth between 6.5% and 7.0%.

In the medium term, expansion could reach around 8%, supported by major infrastructure developments, oil sector investments, and rising private sector activity.

Global tensions, however, could weigh on trade and commodity prices, potentially constraining growth.

Conversely, stronger inflows into oil, mining, and improved external conditions could drive outperformance. In light of the balanced but uncertain environment, the MPC opted for a steady policy approach.

The lending corridor remains unchanged, with the rediscount rate at 12.75% and the bank rate at 13.75%—the rates at which commercial banks can borrow from the central bank.

“Future policy decisions will remain data-dependent, informed by continuous assessments of domestic and global risks,” Governor Atingi-Ego stated.

The decision reflects the BoU’s dual mandate: guiding inflation toward the medium-term target while avoiding undue restraint on economic activity.