Standard Chartered PLC has announced that it is selling its retail businesses in Uganda, Botswana, and Zambia.

The Group says it will concentrate its resources in these markets on serving the cross-border needs of global corporate and financial institution clients, according to the bank’s Chief Executive Officer.

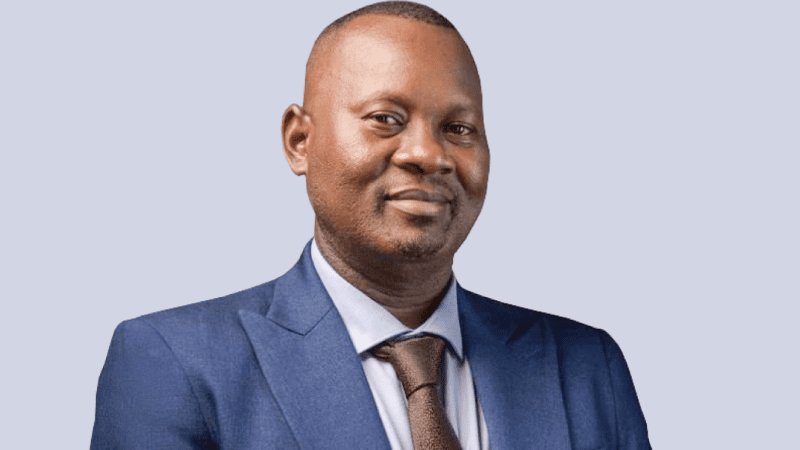

“We are exploring WRB business sales in Uganda, Botswana and Zambia. As a result, we intend to exit from our WRB business in Uganda, subject to regulatory approvals. Standard Chartered will remain in Uganda, with a sole focus on our Corporate and Institutional Banking (CIB) business. We see substantial opportunities in infrastructure, sustainable finance, and trade, reinforcing our commitment to these areas within Uganda and, indeed Africa,” said Sanjay Rughani, the Standard Charted Bank Uganda said.

“We are taking a phased approach and the process is expected to take between 18 to 24 months to complete. Therefore, we urge the public and our customers to remain calm. We remain open for business; our branches and systems continue to work as normal – it is business as usual. In addition, we are committed to managing this process in partnership with our key stakeholders to minimise disruption for clients. We will keep our stakeholders fully informed as this process goes on.”

Mr Sanjay stated that Standard Chartered Bank continually reviews its operations to ensure that we concentrate resources where we have the most distinctive client proposition. The sale of our WRB business will allow us to focus our resources where we can play to our strengths and best serve the cross-border needs of our CIB clients.

He stated that as a Bank, we have invested heavily in recent years in Uganda and indeed, Africa, which remains core to our global network. In a recent impact report by Steward Redqueen, the findings revealed that Standard Chartered Bank Uganda has over the years supported $896 million in value-added impact in Uganda (3.5% of GDP) and supported 491,000 jobs directly and indirectly. More recently, the Bank has funded infrastructure projects worth over $1billion.

Standard Chartered Bank has in the past divested in other markets like Tanzania and Ivory Coast and the outcome for both the Business and Bank colleagues has been very positive as it has accelerated the growth of the Corporate and Institutional Banking Business.