The National Social Security Fund (NSSF) has today launched a Voluntary Membership Plan that will provide employers and workers that are not compelled by the mandatory provisions of the NSSF Act the opportunity to voluntarily save for their retirement.

The Fund also introduced a mobile money platform through which it will receive voluntary savings through its code *254#.

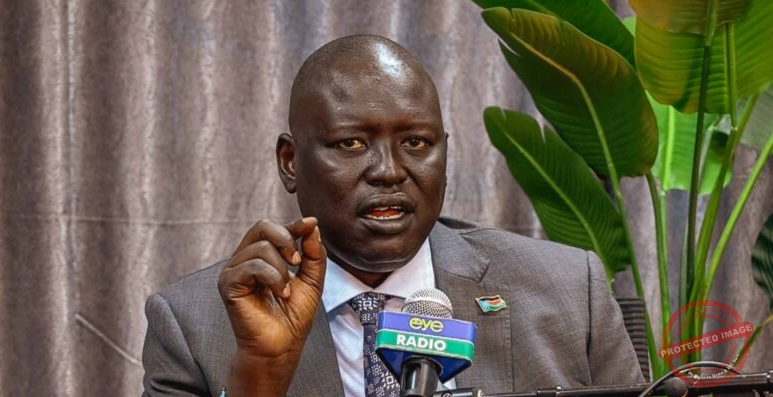

Addressing journalists at Workers House in Kampala, the NSSF Managing Director Richard Byarugaba said that the Fund is responding to a need for a voluntary savings option by many Ugandans as well as enhancing the Fund’s growth strategy in terms of membership and contributions.

“The NSSF Voluntary Membership Plan will enable us recruit and register 2 types of voluntary members – Voluntary Employers – Under NSSF (Voluntary Registration and Contributions) Regulations, and Individual Voluntary Contributors with specific reference to Sections 10 (1) and 10 (3) of the NSSF Act respectively,” he said.

“Under these provisions, we will recruit and register employers with less than 5 employees as well as accept contributions from former NSSF members, whom we paid their respective benefits, but are still able and willing to save with us,” he added.

Byarugaba said that there is a potential customer base of close to 2 million workers who do not have any form of social security cover out of about 4 million Ugandans working in the formal sector.

Giving assurances on the viability of the NSSF Voluntary Membership Plan, given the low savings culture in Uganda, Byarugaba said that the trend is improving and the Fund has already tested the market and received positive feedback.

“We have been piloting this plan in the market and it has been well received. As at end of May 2017, we had recruited 3,017 voluntary employers, and have collected over Ugx 2.6 billion”.

“In addition, we recently carried out a survey and about 19% of workers in the formal sector who do not have social security cover told us they would start saving as soon as the Fund started a Voluntary Membership Plan, which is about 836,000 people. There is also an additional 700,000 former members of the Fund whose accounts are currently inactive mainly because their employers no longer remit contributions, or are now self-employed. They would like to continue save with us,” he said.

In addition to receiving contributions, the Fund is also set to start paying its members who qualify for their benefits through mobile money via its existing NSSFGO code *254# accessible to the MTN and Airtel subscribers.

Byarugaba said that mobile money is a channel the Fund must embrace not only for the convenience of contributors and beneficiaries but also because it offers a number of advantages.

“It eases reconciliation with an option of automating the upload of contributions onto members’ accounts, enables submission of only correct information, and instant confirmation of received contributions to the member through automatic text messages. It will also provide single trip convenience to members accessing low value benefits,” he said.

The press conference was attended by the Private Sector Foundation Uganda Executive Director Gideon Badagawa, Uganda Manufacturers Association Executive Director Mubaraka Nkuutu, who applauded the Fund for introducing the plan and pledged to work with the Fund to promote it among their members.

The Fund has registered consistent membership growth over the last 6 years. Last Financial Year, over 106,000 new members and over 2,800 employers were registered. The Voluntary Savings Plan is expected to accelerate this growth in the medium and long terms.