Airtel Mobile Commerce Limited, the provider of affordable and secure financial services in Uganda has today announced the addition of the Merchant Till Number for small businesses feature on Airtel Money.

The service suitable for informal businesses like market vendors, salon operators, boda boda riders on the Airtel network will now be able to separate their business money collections from personal money using their existing Airtel SIM cards.

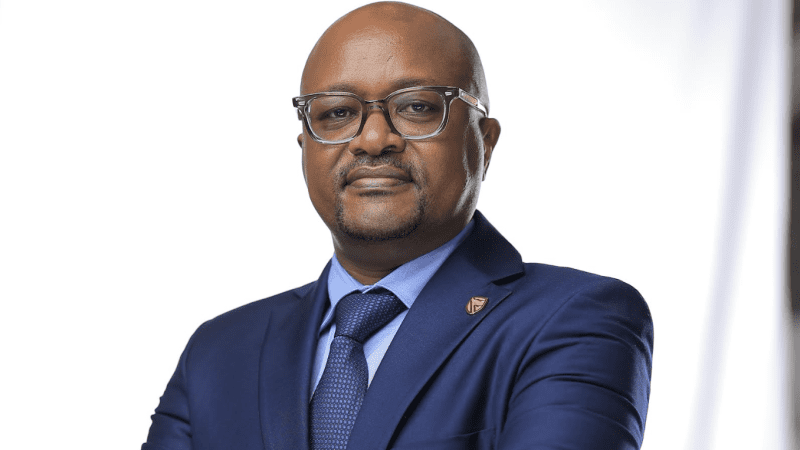

This service was unveiled today by the AMCUL Managing Director, Mr. Japhet Aritho at a function at Nakawa Market. The function was attended by representatives from the different Kampala markets.

Effective today, regular Airtel Money customers and business owners across the country, using their existing SIM Cards, will be able to separate their business finances from their personal airtel money wallet by using the USSD Code *185*10*10# to create a Unique Merchant Till Numbers.

They can then use this number to;

- Receive payments for goods and services from their duuka, boda rides, saloon, etc.

- Transfer money from the till number to their Airtel Money number and

- View balances on both their new Merchant Till Number and personal Airtel Money wallet.

While launching the new service, Mr. Japhet Aritho, the Managing Director Airtel Mobile Commerce Limited (AMCUL) noted, “We are committed to delivering on our promise to grow financial inclusion for all in Uganda. Today, we have enabled small businesses, in the comfort of their shops, to create the Airtel Money Merchant Till Number. This is the first tool in business basic financial management. It will help these growing businesses to focus on growing their businesses and tracking their revenues better”

He added, “Airtel has deliberately built a telecom infrastructure of over 21,000 site masts across Uganda, and it is on the back of this infrastructure that innovative solutions like the Merchant Till Number service have been made possible. Customers can enjoy seamless boarder to boarder connectivity, get access to affordable devices, and affordable e-commerce solutions.

According to Uganda Communications Commission (UCC) 2021 quarter 3 report, the number of active mobile financial service agents grew by a factor of 11% from 285,371 in June 2021 to 315,895 by the end of September 2021. This reflects a sustained increase in business activity that is gradually positioning the mobile as a financial tool. In comparison to 2020, the agent footprint across the country has grown by 39% and over 88,000 mobile money agents have been added to the distributed file system ecosystem over the last twelve months.

Japhet concluded saying, “The new Micro Merchant Till number service will boost business as the proprietors will have proper accountability and oversight of their business. They will know the income that is resultant of the business transactions separate from their personal transactions. The users will, using their current SIM cards, be able to monitor up to 10 different branches of their small businesses.”