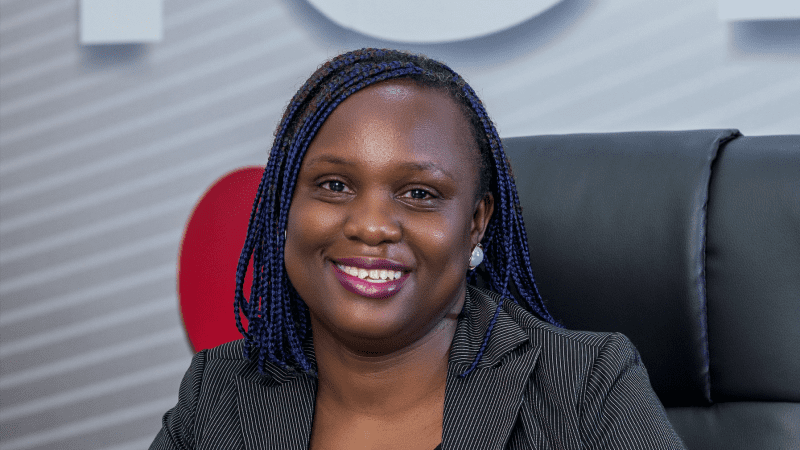

By: Angela Dragu

To many Ugandans the month of May 2022 will forever be remembered by the gruesome tales of the many motor accidents that happened and the fatalities that came as a result across the country. The scale at which lives and property were lost had not been witnessed in a while. As an insurer with my many years in this industry my mind could not help but wonder about the liabilities involved.

From my own experience when such accidents happen they draw in so many entities like the families of the deceased, occupants of the vehicle who are nursing injuries, pedestrians or passers-by injured or deceased and owners of the property that was destroyed i.e. houses and structures (all commonly referred to as third parties).

If someone was looking for the meaning of liability… that there is liability, ladies and gentlemen so imagine you as the owner of the vehicle in question, having to deal with all these parties each with their own interest and claim, how do you even start to compensate them?

If the vehicle was a commercial one like a bus, lorry or a matatu taxi, then you have probably lost equipment worth millions, lost experienced human resource who knew the business (the routes and had even created a special bond with customers). Most importantly as a business your brand reputation is under question, remember safety is king in the transport business.

You see the thing with accidents is that we tend to lose a lot more as individuals, companies and as a country than meets the eye. From the lives lost, people incapacitated (some are bread winners, others are the future work force that would probably add and positively contribute to the economy) and not to mention property used to generate revenue and wealth is destroyed.

To put it further into perspective according to the Annual Police Crimes report 2020 on average 10 people die on the road every day, the same report states that road accidents cost the economy 4.4 trillion Uganda shillings and that is 5% of our GDP (Gross Domestic Product).

As a victim and as a business how do you bounce back from such a setback? In all honesty, you cannot replace life but what about the families of the deceased? In the event that your employees have a life insurance policy, the families of the victims will receive some respite. As a result, it seems necessary for businesses to provide their employees with term life insurance. To help you in this regard, a life insurance calculator for people in Canada (or wherever you are based) could be a convenient tool.

In the perspective of the proprietors of these commercial vehicles it takes years of sheer hard work and sacrifice to build reputable successful businesses only for that to be wiped away by an unfortunate incident. Who is to say that they will be afforded the same time, resources and opportunities to bounce back again?

That is why understanding how insurance works, assessing risk, and having an appropriate cover or an insurance policy in this line of work or for any motorist on the road is not a luxury but a basic requirement. Had it been life insurance, you might have put maximum thought behind it, read the reviews (like this selectquote reviews, for example), approached the right firms, selected nominees, and so on, right? Similarly, the same effort needs to be put into motor insurance too. That’s why it might be imperative for transport business owners to contact a local insurance provider who can assist in securing the loss incurred due to any major accidents. For example, if you live in California, you can get California taxi insurance from a service provider like Oswald Taxi & Transportation Insurance Services. Here, the role of insurance is to help you return to your original position when life takes an expected turn for the worst.

However, it is not just insurance that motorists need. They also require the help of a personal injury attorney who could help them cope with the loss and get the deserved compensation. As an example, if someone in Ohio is involved in a fateful car accident caused by another driver’s negligence, along with having insurance for his/her life and vehicle, such a person will also need to contact an Ohio Personal Injury Attorney to assist him in preparing for the claim and guiding him through the entire process, so they get the compensation they deserve. This is an important step as it can ensure that the victim receives the monetary aid that is needed to kick-start his life again. Needless to say, for this to happen, the victim must have insurance policies, which is why insurance is emphasized as the most important document a motorist needs to have.

That said, motorists need motor third party insurance (statutory requirement to take care of basic third party injuries), motor comprehensive insurance (to take care of damage to your vehicle, third party liabilities (injury/death and property damage) and other related expenses as a result of the accident) and why not top that up with a personal accident cover (to cater for the medical expenses that will arise in case you get injured).

Long gone are the days when motorists purchased the mandated third party policy and did not have a clue of how it would come in handy. As a motorist one of the most important decisions, you will ever make is to sit down with your insurer, broker or agent to discuss the various policies and find out what suits you.

At MUA Insurance Uganda, we spare time to sit down with the client, understand their needs and assess their risks then recommend a suitable policy that works and delivers value i.e. whether it’s a personal or commercial vehicle, a frequent traveller, a farmer, a businessman, having the right insurance cover gives you peace of mind.

Such discussions make a big difference in how you handle a situation the next time you are faced with life’s unfortunate and unexpected turns. All said and done it is our individual responsibility to keep our lives and those of other motorists and road users safe. Let us drive safely and all lives matter.

The writer is the Head of client servicing and customer care at MUA Insurance Uganda