Equity Bank Uganda has today launched a women-based product dubbed Equi-mama. The product is a transformative credit facility designed to unlock the entrepreneurial potential of women in rural Uganda.

Equi-mama credit facility aims to provide women with access to affordable capital, equip women with business skills, offer them mentoring, expose them to business networks, and equip them with the tools they need to succeed in business.

Speaking at the launch of the product at the Ntungamo Municipal Grounds, First Lady and Minister for Education Janet Museveni applauded Equity leadership for creating a product that specifically benefits women.

“I requested Equity Bank to open a branch in Ntungamo and secondly, to provide a product that would specifically benefit women at the grassroots. I wanted to see our women walk into a bank and borrow money for their small-scale businesses with ease. So, today, I am so grateful to God for answering that prayer, as we launch the Equity Bank Branch in Ntungamo District and the Equi-Mama Product, which is specifically designed to meet the needs of small-scale women and youth entrepreneurs,” said Mrs Janet Museveni, as she launched the product.

She added, “I am grateful to Equity Bank for extending its banking services to Ntungamo District and for considering women and the youth, who have long faced difficulties in obtaining loan facilities, due to the lack of collateral, as well as limitations in exercising their property rights. “

Mrs Museveni pointed that while women and the youth play an important role in society, they rarely have access to credit facilities, while many are limited by lack of financial literacy, regarding the products available to help businesses succeed.

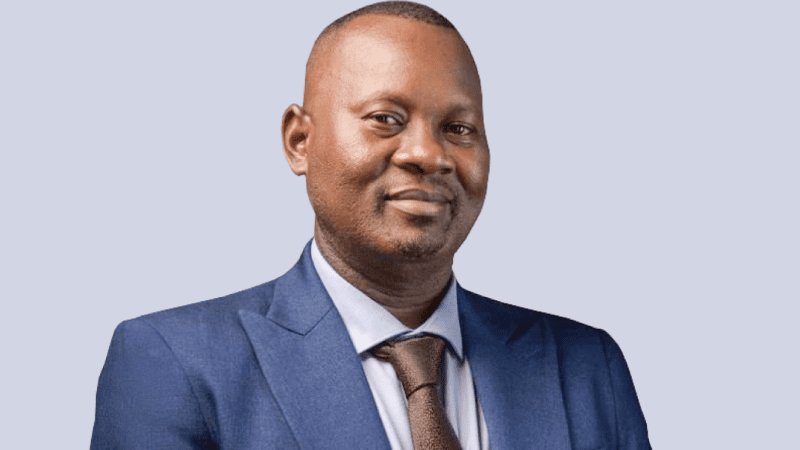

Equity Bank Managing Director Anthony Kituuka affirmed that women entrepreneurs through the Equi-mama proposition truly have something that will boost their businesses, mitigate against business and household risk and have access to affordable funding and free financial education.

“Equi-mama is designed specifically to address the unique needs of women at the micro level. We have taken a customer-centric approach, conducting extensive research to understand the financial challenges women at the bottom of the economic pyramid face and how we can help them overcome these challenges,” said Mr Kituuka.

Adding, “We have also taken steps to ensure that the product is accessible to women of all backgrounds and income levels. We offer flexible payment options and no application fees making it easier for women to access our services.”

Kituuka said Equity’s free financial and entrepreneurial literacy training is aimed at addressing hurdles such as record keeping, accounting, and long-term business planning. The Financial education will make it also easier for digital and remote onboarding for women in business, making access to finance much easier.

The latest product of the bank also offers women at micro level unsecured loans from as low as UGX5m to UGX40million. It also comes with insurance for maternity, life, catastrophe, fire, and temporary or permanent disability. During maternity, the bank gives the female customer maternity support which also includes antenatal insurance.

Already, the Bank has trained over 89,000 women in various aspects of business development and growth and given loans to over 20,000 women in various groups under the program. Equi-mama was first developed in 2021 to address challenges faced by women affected by the covid19 pandemic.

Through the product, the bank will support rural women to develop their business management skills through access to free financial training. This will give women the knowledge, skills, and tools they need to gain better access to finance and move their businesses to the next level of growth.

Equity will also provide business support to women entrepreneurs through tailored business advisory sessions, advanced business workshops, networking, and linking them to financial services, investments, and markets.

Before the product launch, Mrs Museveni opened the new Equity Ntungamo branch which brings the total number of the Banks branches to 50. She was grateful that an African Bank was taking deep root and growing to enable fellow Africans.