The parliamentary committee on Commissions, Statutory Authorities and State Enterprises (Cosase) has adjourned a meeting with Bank of Uganda officials over Teefe Trust Bank inventory report.

Cosase committee chairperson Abdu Katuntu (Bugweri County) pushed the face-off after BoU officials, led by governor Prof Emmanuel Tumusiimwe Mutebile, said they didn’t have the inventory report for Teefe Trust Bank closed in 1993 over insolvency.

“This meeting will be adjourned to Thursday, 10 O’clock, but we need those documents before so that we can look at them before we meet you again,” announced Katuntu on Monday.

“Also come along with the auctioneers that helped you in the selling process.”

Complex Process of Closing Banks

Earlier, committee deputy chairperson Anita Among insisted BoU officials explain the process of closing banks.

“We know that the law gives Bank of Uganda power to open and close banks. We [Cosase] requested for the procedure used in opening and closing banks but you [BoU] did not provide it,” noted Among, the Bukedea Woman MP.

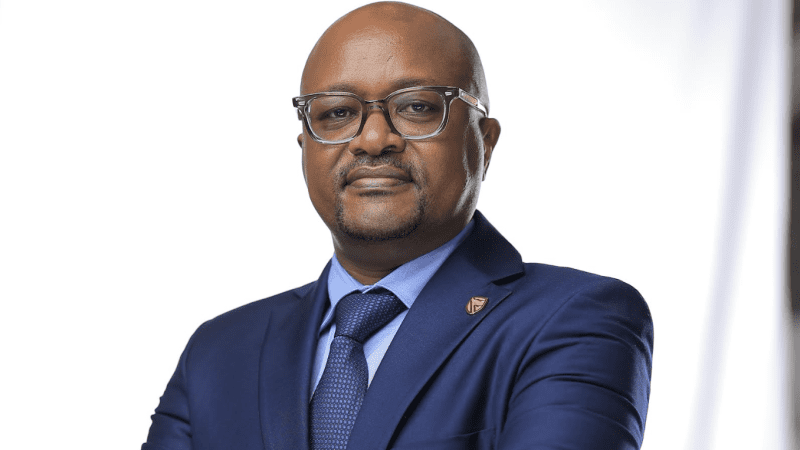

In response, the central bank’s executive director in charge of supervision, Dr Tumubweine Twinemanzi, said BoU “doesn’t have a manual of how it dissolves banks but we are in the final stages of the process of making one”.

On his part, Mutebile told the MPs that “the dissolution of banks is a complex exercise and each bank has had its own circumstances under which it was dissolved”.

He insisted all the closed banks, including Teefe Trust Bank, were insolvent.

“The seven defunct banks in the Auditor General’s report were put under dissolution because they were insolvent” said Mutebile.

“While carrying out bank dissolutions, Bank of Uganda has identified other banks that have purchased assets of the defunct banks.”

In his report on the closure of commercial banks, the Auditor General raised a red flag after MPs wrote to him to institute a probe into the controversy.

The banks include: Teefe Trust Bank (1993), International Credit Bank Ltd (1998), Greenland Bank (1999), The Co-operative Bank (1999), National Bank of Commerce (2012), Global Trust Bank (2014) and Crane Bank Ltd (CBL) (2016).

The central bank governor also appealed to the committee to be be “mindful of the ongoing court cases as they might have an effect on how much information we shall reveal during this probe”.

Tumubweine Twinemanzi: We Can’t Find Teefe Trust Bank Inventory Reports

Even when Mutebile and other BoU officials had asked for more time to look for the documents last week, Twinemanzi infuriated MPs when he said: “We have been unable to find any inventory reports on Teefe Trust Bank. So we don’t have the inventory reports.”

“This process can’t be useful when you don’t know what you took over because an inventory report shows what you took over — assets and liabilities,” said Katuntu.

“Mr Chairman, I think you have to compel Bank of Uganda to bring the inventory report of the banks they took over,” said Kalungu East MP Joseph Sewungu.

“I don’t believe them when they say they don’t have it because how did they take over assets they don’t know.”

Embattled deputy governor Louis Austin Kasekende said the laws in existence at the time of Teefe Trust Bank’s closure didn’t require an inventory report.

“At the time of closure, the 1969 law was in effect and this nature of documents required [by Cosase] did not include the inventory,” said Kasekende.

The central bank officers are now expected back on Thursday.

The committee has also asked for loan schedules of the closed banks.