Standard Chartered Bank has announced it delivered strong performance for the year ended 31 December 2019 with operating profit before tax (OPBT) rising 30 per cent to Ugx 152 billion and operating income increasing 15 per cent to Ugx 461 billion.

Performance highlights include:

- Total income recorded a growth of 15%

- Net profit after tax recorded a growth of 29.8%

- Total Assets recorded a growth of 8%

- Our customer deposits increased by 11%

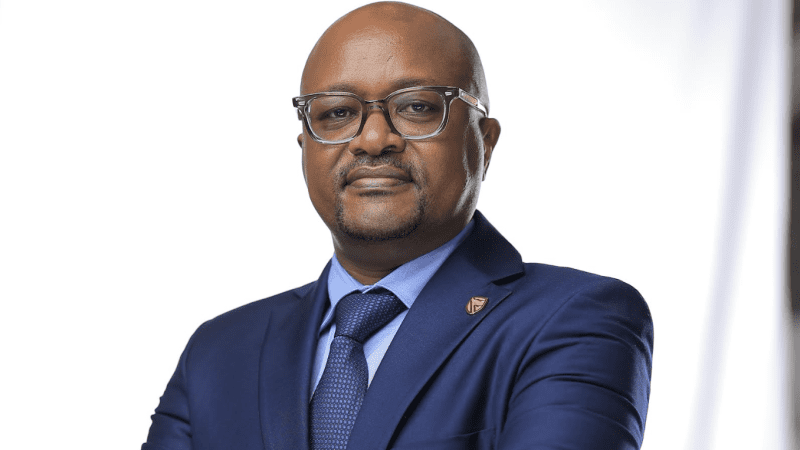

Mr Albert Saltson, Standard Chartered Bank Chief Executive Officer, said:

“We once again delivered record profits for the year ended 2019. There was more breadth and scale in our strong performance spread across our various segments and multiple products. In 2019, we took significant steps to reshape our business by implementing our refreshed strategic priorities, so our positive performance reflects the tangible progress we made against each of them. We positioned ourselves to disrupt and transform with digital, reinforce market leadership by growing our affluent client business, improve our productivity and leverage our global network by capturing the opportunities inherent in our unique footprint to support and grow with our clients. We continued to deliver innovative services and unparalleled digital platforms, leveraging on our strong group network, and the expertise of our local and global colleagues with deep understanding of the Uganda economy and its drivers. To deliver this performance, we continued to drive employee engagement as our People remain at the heart of our operations. We therefore focused on building an inclusive, innovative and performance-based culture that ensured that our Employee Value Proposition promotes competitive rewarding and a work-life balance. Furthermore, we also supported communities by launching the Futuremakers by Standard Chartered programme where we delivered community programmes focused on Education, Employability and Entrepreneurship to tackle inequality and promote economic inclusion for young people in our communities. We also reached 9,000 girls under our Goal programme raising our total reach to 35,000 girls since inception in 2014 and we trained over 500 young people with skills of managing personal and business finances through our Financial Education programme. Our Seeing is Believing programme made significant strides towards giving over 1 million Ugandans free access eye health services and visually impaired persons access to education.” Albert concluded.

Balanced growth:

Our Corporate and Institutional Banking (CIB) maintained a strong presence in the China-Africa corridor, supporting key infrastructure projects whilst creating new networks for Uganda with businesses in China. We collaborated increasingly with other segments, introducing Commercial Banking services to our clients’ ecosystem partners which comprises of their networks of buyers, suppliers, customers and service providers – and offering our clients’ Employee Banking services through Retail Banking. We are committed to sustainable finance, by increasing support and funding for financial products and services that have a positive impact on our communities and environment.

Under Commercial Banking in 2019 we focused on creating new partnerships through new client relationships while remaining close and relevant to our existing client base. To enhance client experience; we boosted our Transaction Banking offering by enhancing our Liquidity Management proposition through Straight to Bank (S2B) and thereby increased the use of National Collection Services (NCS), Mobile Money payments and collections. We also partnered with our Sovereign Solutions team to initiate key projects aligned to the Government’s strategy aimed at infrastructure development. Furthermore, we supported the manufacturing sector through connections with various stakeholders within the value chain. Leveraging on our Global presence, we enabled the channelling of investment flows into Uganda’s manufacturing sector from China, Europe and Americas.

Retail Banking had yet another strong year with significantly higher business volumes and income momentum across all its segments. The biggest differentiator was the launch of real-time client on-boarding through our Standard Chartered Mobile App, offering access to over 70 services online which enhanced our clients’ experience and improved efficiency leading to growth in digital adoption. Our Wealth Management proposition was the largest Retail Banking contributor as we continued to invest in our affluent clients which was further enhanced by the launch of Bancassurance solutions. We also focused on harnessing the power of partnerships through alliance initiatives to provide value addition and discounted offers to our clients.

Some of Retail Banking key milestones achieved in 2019 included;

Customer acquisition through digital banking grew fivefold, we went paperless with the launch of a staff-assisted platform which enables customers to open accounts directly on the digital platform, we initiated offering of preferential online rates to our individual and business banking clients, over 86% of our client interactions with the bank now happen outside the branch, we launched Keyboard Banking where clients do not interrupt their social conversations to do their banking, we enabled Peer-to-Peer transfers to M-pesa (Kenya), Bank account (UK) and Credit Card (South Africa) reducing transfer costs by 90% and launched Agent Banking enabling our clients to deposit or withdraw money at any of our authorized agents or any bank agent on ABC platform.

2019 ended with the Bank in great shape with a firm foundation and strong momentum in all businesses and segments however the start of the year 2020 has had an unpredictable trend of events with the onset of the COVID 19 pandemic leaving our business susceptible to the resultant impact and local plus global shocks. We will keep pushing our digitization agenda to drive our organic growth momentum. 2020 is undoubtedly a test, but it will also be exciting with new opportunities emerging alongside new risks.