Civil society organisations have expressed concern over government’s awarding of tax holidays to investors, arguing that government lost a lot of money in exemptions that could hurt the economy the more.

The officials observed that Uganda’s tax to GDP ratio had remained between 12.5 per cent and 13 per cent over the past five years

Uganda forfeited Shs 999.8bn to tax holidays in FY 2015/16.

The officials were also concerned that “Information about tax holidays and incentives remains a preserve to technocrats” and that “there is no routine review of impact and benefits”.

The officials were further concerned that the country was losing a lot of money by exempting Savings and cooperative societies from paying taxes.

Such Saccos include the Parliamentary Sacco whose members also enjoy exemptions on their allowances amounting to Shs 54bn annually.

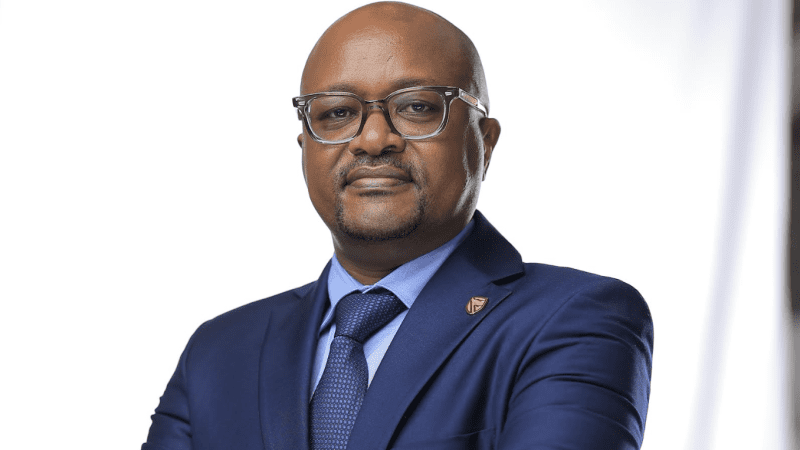

According to Csbag’s Julius Mukunda, “There’s too much politicking in offering tax exemptions.”

Last week, Parliament blocked a plan by government to exempt Bujagali Power Project from taxes for 15 years. MPs instead approved a five-year holiday.

“Why should a company get tax holiday for more than 5 years? This has continuously depleted the national treasury,” Mukunda said.

“Ugandans need to clearly understand how tax exemptions will benefit them.”