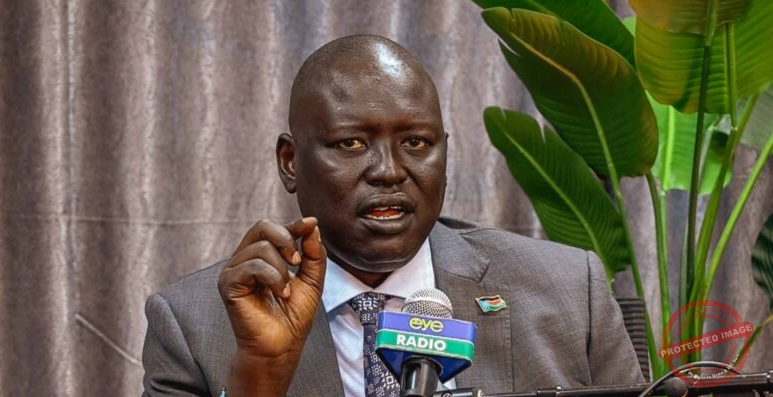

The Finance Minister Matia Kasaija has, on behalf of President Museveni, tabled the 2020/2021 budget estimates, with Ministry of Defence and Veteran Affairs taking the lead at over Shs4.3 trillion.

The details are contained in the Appropriation Bill 2020, which the Public Finance Management Act requires the Finance Minister to lay before Parliament by 01st April.

In recurrent expenditure, Shs1.4 trillion is proposed to be set aside for “expenditure on salaries and other expenses in the Office of the Minister of Defence Headquarters, UPDF Land Forces and UPDF Airforce under Ministry of Defence.”

The Development Budget on the other hand, has Shs2.9 trillion, the bulk of which is to finance classified activities and procurements.

The total recurrent expenditure stands at Shs11.8 trillion.

The Ministry of Health has up to Shs1.2 trillion as development budget, with Shs72 billion reserved for salaries and other recurrent expenditure at the headquarters.

Other health facilities and compliant institutions have separate budgets, like the Uganda Heart Institute and all hospitals.

The Ministry of Energy and Mineral Development has a total of Shs1.8 trillion as development budget exclusive of salaries, largely meant to finish ongoing construction of dams and extension of electricity connection in the country.

Shs636 billion is proposed to support the Rural Electrification Agency to deepen electricity penetration across the countryside.

Shs68.6 billion has been earmarked to support the ongoing construction of the Parliamentary Chambers expected to be at over 60 per cent completion by the end of the financial year in question.

Ministry of Works and Transport retains its dominance through its resurgent MDAs’ budgets.

The Uganda National Roads Authority is getting Shs3.4 trillion and the headquarters have Shs1.3 trillion as its development budget.

The Uganda Road Fund intends to take home Shs16.3 billion for the rural roads and small bridges.

Kampala Capital City Authority will get Shs314 billion for its roads and drainage systems.

The estimates now go before the Committee on Budget which will scrutinize and make adjustments in line with the sources of revenue available to be tabled in tax laws expected in the coming days.

This is supposed to go through rigorous changes as it will be the maiden budget to respond to the devastating effects of Covid19, which is expected to bite crucial sources of revenue like tourism, which are now under shutdown.

With slow business in the economy, the Uganda Revenue Authority (URA) will have to be innovative to close the gaps and spur support to the budget.

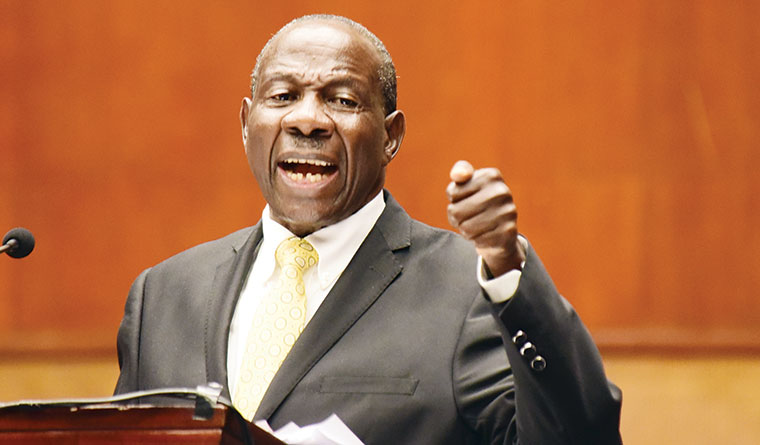

President Museveni, in several televised addresses, exuded confidence in the economy closing the gaps created by a decline in imports, an opportunity he said local industry should seize to grow industrialization.

In a tweet , Museveni appointed a new Commissioner General of URA, John Musinguzi, his longtime advisor and UK-trained statistician.

The move is seen as his strategy to close taxation gaps and raise the tax to GDP ratio, currently snailing at 14 per cent, the lowest in the East African region.