South Sudan’s President Salva Kiir has fired two undersecretaries of the finance ministry as well as the undersecretary of the ministry of health, state-run media announced.

No reason was given for the move, but it came after a rapid depreciation of the South Sudanese pound. On Monday, prices of the hard currency in Juba stood at about SSP 970 for USD 1.

Corruption, mismanagement and lack of local production are often blamed for South Sudan’s economic troubles.

The South Sudan Broadcasting Corporation read out an executive order which announced Kiir had decided to relieve the First Undersecretary of Finance, Ochung Genes Karlo, and the Undersecretary of Planning, Angelo Deng Rehan.

In another decree, Kiir appointed Kuol Daniel Ayulo as the First Undersecretary of Finance and Benjamin Ayala Koyongwa as the Undersecretary of Planning in the Ministry of Finance and Planning.

Also sacked was the Undersecretary of the National Ministry of Health, Victoria Anib Majur. Kiir replaced her with Der Machar Achiek.

Edmund Yakani, a South Sudanese observer, said the ongoing economic crisis in the country requires proper decision-making at the finance ministry posts, including the undersecretaries.

“The practice of giving financial gifts for political elites or friends of the political leaders should be stopped, and serious fights against corruption are required,” he said. The act of auctioning US dollars should be stopped, and the dollars should be directly given to the business community to bring goods at affordable prices to the citizens.”

Government interventions

Last week, The Ministry of Finance reassured worried citizens that rising prices of everyday items, including edibles, would soon be controlled.

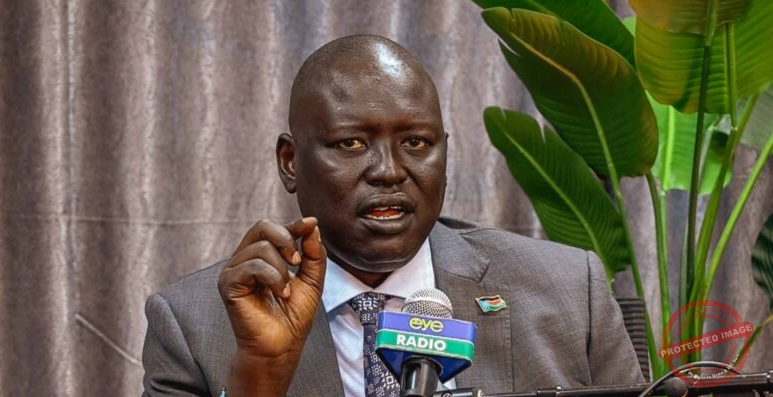

“We have discussed the depreciating exchange rate of our South Sudan Pound. We have reached a concrete solution of central bank availing sufficient dollars into the market to meet the needs of the market, the needs of the people looking for the foreign currency,” Finance Minister Dier Tong said.

“We can assure the market that immediately, the central bank will be able to intervene in the market so that we respond to the higher demand of the US dollar,” he concluded.